Respecting Money: What I Learned from My Financial Mistakes

Money might seem like just numbers in a bank account or a material object in hand. But it shapes our lifestyle, our choices, and even how we spend our time. The simple truth is, we need money to live a good life.

If you get a salary weekly, bi-weekly, or even at the end of the day, why do you need savings too? I think thinking about the future and imagining what even bad things can happen is also a characteristic of being intelligent. If you fail your health, if your family member fails in health, if you want money for a family vacation, if you need money when you retire to live a good life… These examples show that saving money for the future is very important, not just enjoying life.

I’ve made many mistakes with money. Over the years, I’ve wasted more than I’d like to admit—on things I didn’t need, impulse purchases, or expenses I didn’t think through. Looking back, I realize it all came from one issue: not respecting money.

It took me a long time to learn this: if you don’t respect money, it won’t stay with you. Now, I’m trying to change. I’ve learned (and I’m still learning) how to manage money better. Let me share my story and the lessons I’ve picked up along the way.

My Mistakes With Money

I used to spend money without much thought. For example, I’d buy coffee or snacks almost every day, not realizing how quickly those small expenses added up.

At the time, I thought these habits were harmless. “It’s just $2 here, $5 there,” I’d say. But when I finally reviewed my spending, I was shocked. These small amounts added up to hundreds of dollars that I could’ve saved for something meaningful.

The Wake-Up Call

One day, I checked my bank account and realized I wasn’t saving much. I was working hard, but I had little to show for it. That’s when it hit me: I needed to respect my money.

Respecting money means being aware of every expense—not being cheap, but thinking carefully before spending. Even $1 has value. Wasting enough small amounts can hurt in the long run.

Lessons I’ve Learned

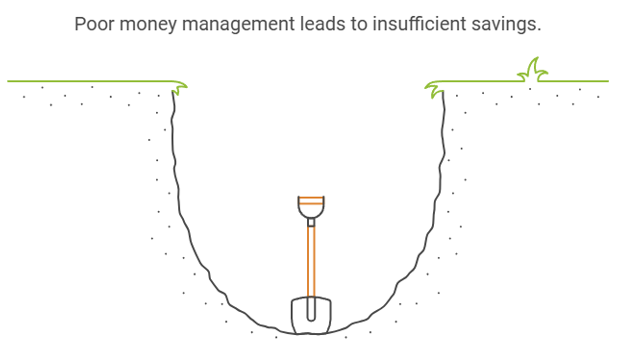

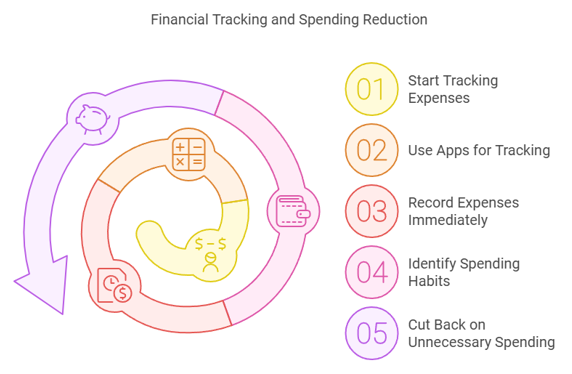

Track Your Spending

I started writing down every expense, no matter how small. You can use apps for this too—just make sure to note expenses immediately so you don’t forget. This habit showed me where my money was going and helped me cut back on unnecessary spending.

Avoid Wasting Money on Unnecessary Things

Before buying anything, I now ask myself, “Do I really need this? Will I still want it in a week?” If the answer is no, I skip it. I also canceled subscriptions I didn’t use, stopped buying sale items just for the discount, and started cooking more at home. These small changes made a big difference.

Use Practical Saving Tricks

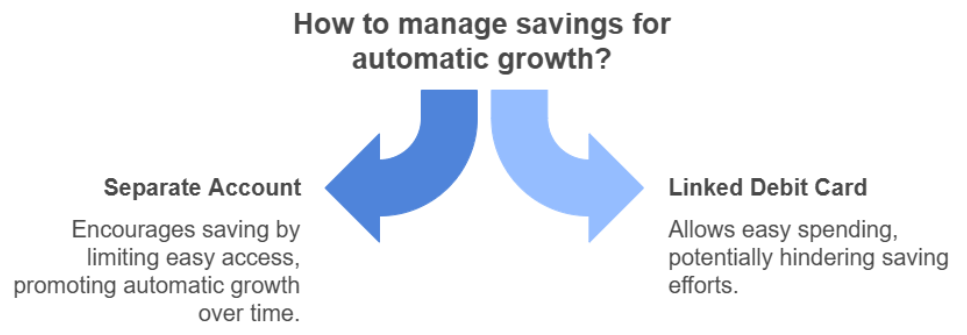

If you have a debit card linked to your savings, it’s easy to spend. One thing that works for me is creating a separate account without easy withdrawal options like an ATM card or online transfers.

When you get paid, transfer half your salary to this account—or as much as you think you can manage without. This forces you to live within your means while saving automatically. Over time, this account grows without you even thinking about it.

Don’t Avoid Responsibilities for Saving

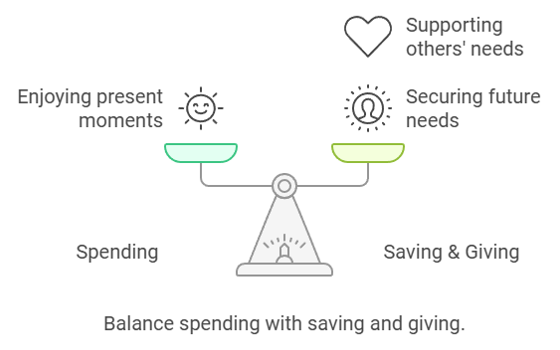

If you have family—parents, a spouse, children—it’s important to spend for them too. Saving doesn’t mean neglecting your responsibilities. Provide for their needs and even their enjoyments, but cut unnecessary expenses where possible.

Think About More Ways to Earn

If your earnings aren’t enough, consider finding a part-time job or exploring online income opportunities. Earning more can help you save faster and make the process less stressful.

Get Rid of Bad Habits That Waste Money

Enjoying life is fine, and hobbies are great. But if a habit is draining your bank account, it becomes a problem. Sometimes we know these habits are bad, but we struggle to control them because of addiction.

Examples include spending on alcohol, drugs, gambling, or other costly pleasures. Tackling these habits is crucial if you want to save money. For many, overcoming these addictions is the biggest step toward financial stability.

Giving is Also Important

Helping others is just as important as saving. When I give to charity or help someone in need, it feels good. Whether it’s a homeless person, a relative, or a stranger, giving money can bring joy to both you and the recipient.

What I’m Still Learning

Respecting money is a process. I’m not perfect yet. I still make mistakes sometimes. But I’ve learned that it’s okay to slip up—as long as I learn from it and keep improving.

I also realize that respecting money doesn’t mean obsessing over it or being afraid to spend. It’s about finding a balance—spending on what matters, saving for the future, and giving to those in need.

Final Thoughts

If I could go back and talk to my younger self, I’d tell myself to respect money from the start. I’d say, “Track your spending, think before you buy, and avoid wasting money on things you don’t need.”

But since I can’t go back, I’m sharing these lessons with you. I hope they help you avoid the same mistakes I made.

Money is a tool, but it’s also something we must respect. If we don’t and don’t care, it slips away, leaving us wondering where it went. So, take control of your finances. Think before you spend, save with purpose, and give with a kind heart.

Most importantly, remember: it’s never too late to start respecting money. I’m proof of that.